Information Central

Local Option Sales Tax

Since the adoption of the Kentucky Constitution in 1891, Kentucky cities have remained preempted from levying a local option sales tax. Section 181 of the Kentucky Constitution does not allow the General Assembly to permit any unit of local government to levy an excise tax, which is a tax paid on the purchase of a specific good. Even though the state collected over $4.95 billion in sales and use tax revenue in FY 2022, the cities of the commonwealth are not afforded the same tax option.

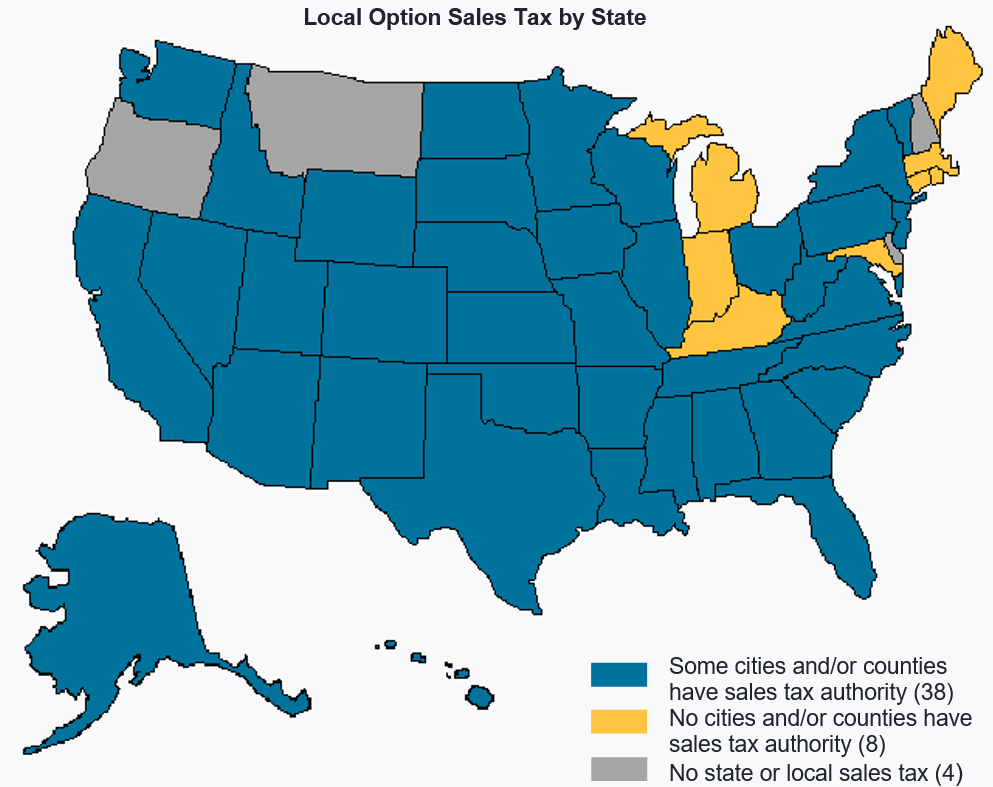

Thirty-eight states currently allow one or more of their local governments to levy a local option sales tax (often abbreviated LOST). Of the eight states that have a state sales tax but do not allow their local governments to have a LOST, most are in the northeast and the midwest. All of Kentucky’s neighboring states except Indiana allow at least one local government to levy a local option sales tax. Local governments in the states where a local option sales tax is not allowed almost exclusively rely on property taxes for tax revenue.

Just because a state allows one or more local governments to levy a local option sales tax, those local governments do not always choose to do so. Similarly, if referenda are required to levy the tax, they do not always pass in their elections. However, cities that propose significant investments in infrastructure and quality-of-life improvements often succeed at the ballot box.