Information Central

Restaurant Tax

Cities of the previous fourth and fifth class are authorized by KRS 91A.400 to levy a tax on restaurant sales to fund local tourism commissions. All money received from a restaurant tax must be turned over to the community’s tourism and convention commission. A consolidated local government is authorized by KRS 153.460 to impose a restaurant tax to fund the operating costs of a multipurpose arena.

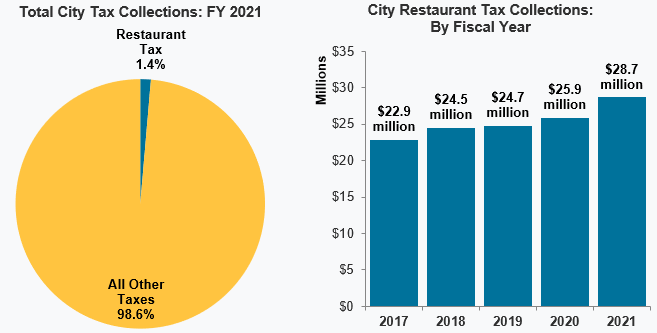

Only around 20% of cities allowed to levy a restaurant tax have chosen to do so. Although restaurant taxes accounted for only 1% of total tax collections, they provided $28.7 million in revenue in FY 2021.

Resources

- List of restaurant tax rates of Kentucky cities (PDF) *subject to change at any time

- KLC Research Report: Today's Kentucky City - A Comprehensive Analysis of City Operations (link)

- COTC Training Opportunities (link)

- Chapter 16 of the City Officials Legal Handbook (link)

- KRS 91A.400 (link)

- KRS 153.460 (link)