Information Central

Occupational License Tax

Occupational and business license fees, which are levied for the purpose of producing general revenue, are essentially taxes instead of regulatory license fees. Kentucky courts have consistently held that cities have the power to impose monetary charges on businesses and occupations for the purpose of producing general revenue. As a result, both state statutes and court decisions have referred to them as taxes.

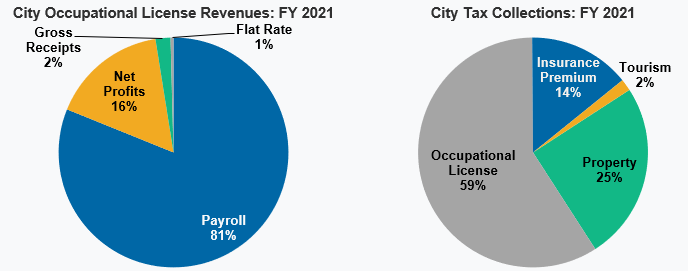

Occupational license taxes may be imposed as a percentage of gross earnings (payroll) on all persons working within the city or on gross receipts or net profits on all businesses within a city. A flat annual rate may also be used by cities, which is often referred to as a business license fee. Occupational and business license fees constitute a charge for the privilege of working in or conducting a business within a city.