Information Central

Property Tax

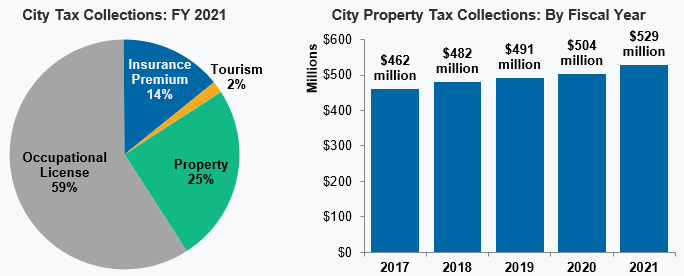

Taxation on real and personal property makes up a significant portion of city tax revenues. Property can only be taxed on an ad valorem basis, which is a percentage of the total market value. Property taxation is highly regulated in terms of what can and cannot be taxed as well as the amount of tax burden that can be levied on property.

Cities of the home rule class conduct annual assessments on all taxable property (other than motor vehicles and motorboats) to gauge the appropriate amount of property tax due. This can be accomplished either through a county (the property valuation administrator) or city assessment office.

Current exemptions exist on many items and situations such as fraternal organization finances, private land for senior citizens, transient mobile homes, and more. For this reason cities should be aware of what they can and cannot tax within their jurisdiction. Maximum property tax levels also vary based on the size of the city, and House Bill 44 (1979) placed strict limits on raising property tax rates from year to year.

Resources

- FY 2023 Kentucky city property tax rates (Excel)

- 2024 City Property Tax Rate Calculation Workbook (Excel)

- KLC Research Report: Today's Kentucky City - A Comprehensive Analysis of City Operations (link)

- COTC Training Opportunities (link)

- KLC Legal FAQ: What is the procedure for increasing a city's ad valorem tax rate? (link)

- KLC Legal FAQ: How can a city collect delinquent real property taxes? (link)

- Chapter 16 of the City Officials Legal Handbook (link)

- KRS 132.027 (PDF)

- KRS 134.420 (PDF)