Information Central

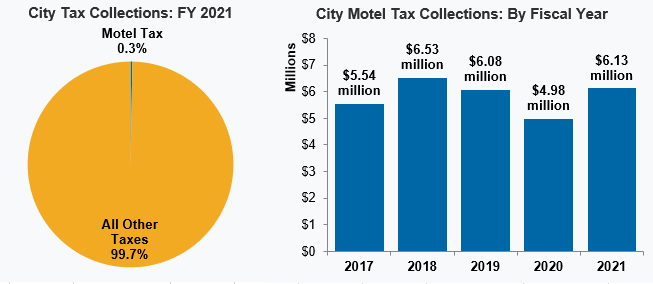

Motel Tax

Cities that have established a tourist and convention commission may levy a motel tax, also known as a transient room tax, which taxes the rent of rooms in hotels, motels, and similar lodging. Revenue from the motel tax must be maintained in an account separate from all other funds and revenues. A portion of the funds must be provided to the tourist and convention commission to fund its operations.

The city legislative body may, with the advice and consent of the tourist and convention commission, determine an amount of the tax to be used to finance the acquisition, construction, operation, and maintenance of facilities useful in attracting and promoting tourist and convention business. The remainder of the funds must be used to promote and develop convention and tourist activities and facilities.