Information Central

Opportunity Zones

An opportunity zone is an economically distressed area where new investments, under certain conditions, may be eligible for preferential tax treatment. Legislation temporarily allows taxpayers to defer the recognition of capital gains that are invested in opportunity zones.

Localities qualify as opportunity zones if they are nominated for that designation by the state and that nomination is certified by the Internal Revenue Service (IRS). To qualify for nomination as an opportunity zone, a census tract must meet the following low-income requirements as defined by U.S. Internal Revenue Code Section 45D(e):

- A poverty rate of at least 20%

- A median family income of:

- No more than 80% of the statewide median family income for census tracts within non-metropolitan areas.

- No more than 80% of the greater statewide median family income or the overall metropolitan median family income for census tracts within metropolitan areas.

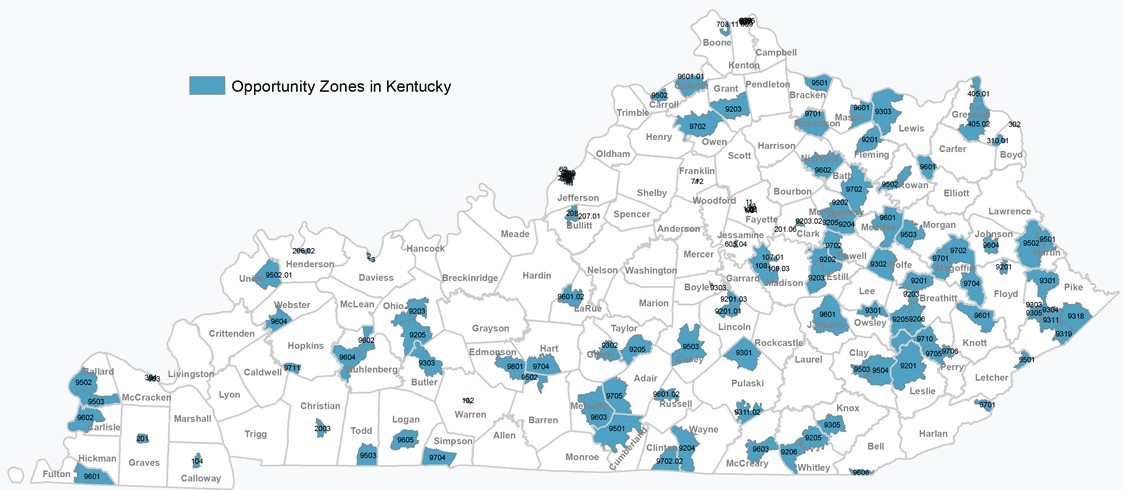

In the Commonwealth of Kentucky, there are currently 144 sites in 84 Kentucky counties designated as opportunity zones, both in rural and urban areas.