Information Central

Debt

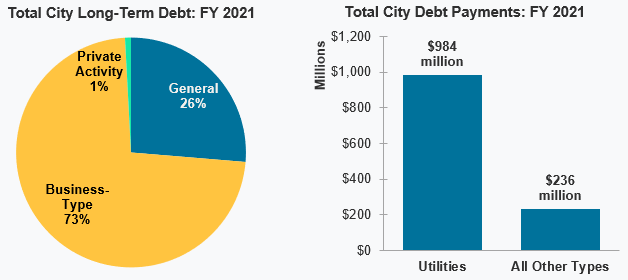

Cities often have important infrastructure or other investments that are better paid for over time. Equipment, facilities, and other long-term capital expenses are often financed through municipal borrowing. Although public debt can be viewed negatively, it is often the best option for purchasing long-term capital assets so those who benefit from such assets in the future concurrently pay for them.

These investments can be handled in a number of ways. Bonds, notes, tax increment financing, and certain leasing options are the most typical modes of financing, and they take the form of either short-term (less than a year) or long-term (over a year) obligations. Cities often enjoy low interest rates because municipal financing has historically been very low risk, so they can pay for capital needs rather inexpensively.